These days, crude oil is trading at close to $30 per barrel, which is an extremely low price in historical perspective. The price is so low that it threatens the entire US shale oil industry and leads to massive fiscal deficits in other oil producing countries, such as Saudi Arabia and Russia. If the price drops even lower, it might even approach the underlying cost of production of the more expensive traditional oil fields in the Middle East and Russia.

The consensus explanation is that the low oil prices are fueled by a combination of two trends: the first is a supposed oil price war where OPEC/Saudi Arabia wants to protect its market share of the oil supply and put primarily US shale oil out of business, and the second being an underlying weak demand for oil due to poor economic growth in China especially. The assumption is then that oil prices would eventually recover when supply and demand has become balanced in a few years, as a consequence of the weakest producers having been forced to shut down and an economical recovery. Oil production would then start to increase again once demand picks up, perhaps plateauing at 95-100 mboe/day in a peak oil scenario.

I see another scenario. What if the demand for oil never picks up again and only declines from now on? This may sound ridiculous at first, but this is what has to happen if the world is going to live up to the motto of being free of fossil fuel in any near future. Environmentally friendly politics and hard measures to limit climate change have actually been on a winning streak during the last year. For example, at the G7 summit in 2015 there was an agreement to phase out fossil fuel use by the end of the century, and in the following Paris climate accord, the pledges from the individual countries ("called INDCs") include drastic reductions of CO2 emissions as soon as 2030. These would have to include oil and gasoline emissions as well, so a lower oil demand is definitely on the horizon. Up until 2014 or so, the financial markets seemed to dismiss this whole idea and the energy commodities and energy stocks traded in a business as usual scenario, but it appears to me that the market may not be so sure that the politicians are bluffing anymore and have started to batten down the hatches.

There is "talk" in the oil markets that the big oil producers are now essentially liquidating themselves in a controlled way by selling off undeveloped oil fields and cutting down on investments. The recent news that the Saudi Aramco state oil company might go public could be interpreted in the same way: the Saudis scrambling to get money out of their oil investments. The reason behind the panic might be that the big oil producers "know" something, namely that they will never be able to develop those fields in the future and recover the oil due to weak oil demand, presumably as result of aggressive taxation and regulations.

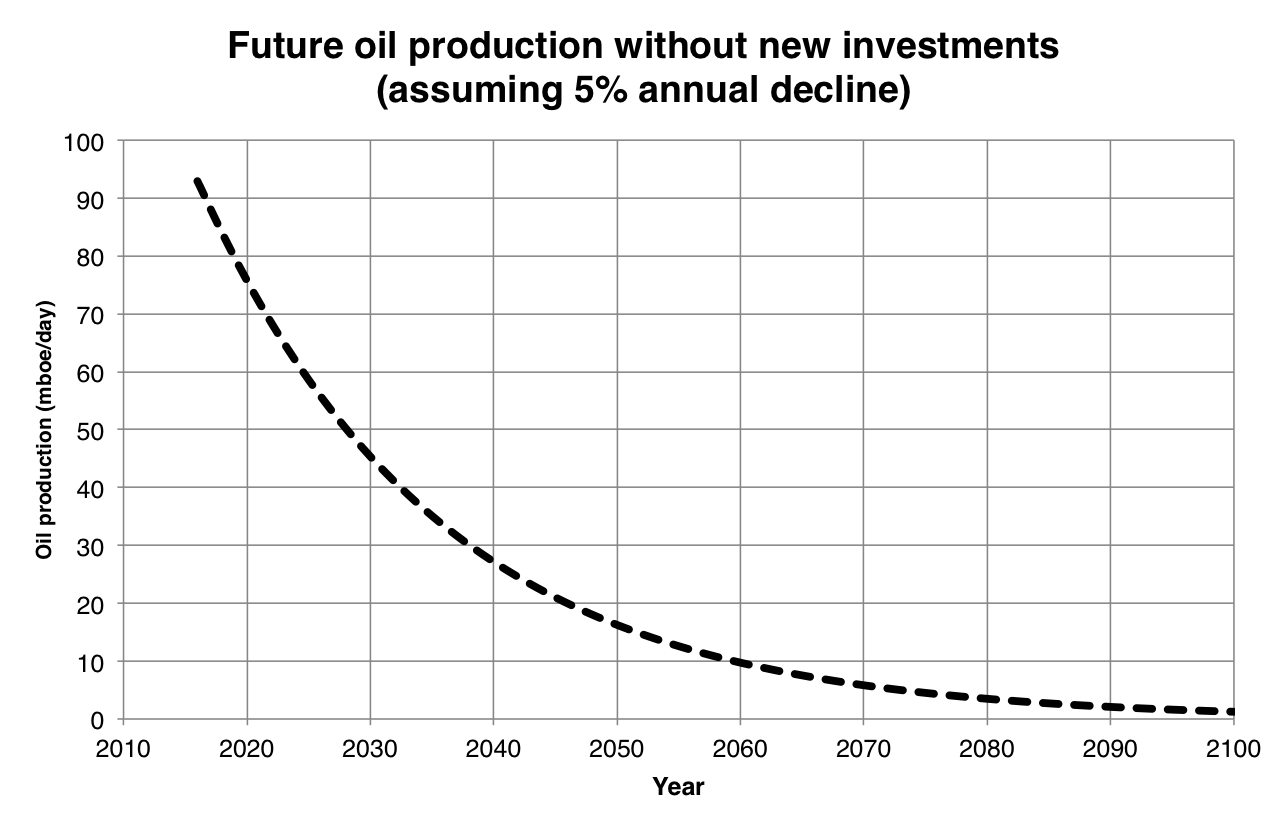

Now, the counterargument often heard is that this trend is obviously unsustainable because the production of existing oil fields decline naturally by about 5% per year, so you need to develop new fields just to keep production stable. But what would it look like if no new oil fields were developed at all and the old ones keep declining? To get a feel for it, I plotted today's production (about 93 mboe/day) and extrapolated forward to the end of the century, -5% per year.

By 2050, we are down to about 15% of current production, and by 2100 the oil production is completely phased out. This looks an awful lot like the G7 scenario mentioned above and might be a very realistic scenario if we are to believe the promises made by politicians today. So perhaps the market knows something: that peak oil has come, but for a completely different reason than originally thought.

I think that the lesson from this scenario is that we need to think about how we would live our daily life in a world with a lot less fossil fuel available. For example, how would you handle the situation where you could only use about half as much gasoline as today? That might be a reality in as little as 15 years. It might not be a big problem if you have an electric car, but what if you cannot afford it?